Table of Contents

ToggleIntroduction

Managing organizational finances can feel like walking a tight rope, and one wrong step can disrupt everything. Reliable accounting support transforms that balance into a steady rhythm, helping organizations stay agile, compliant, and confident about their financial future.

Understanding the Financial Maze

Financial management comes with endless challenges due to changing regulations, cost controls, and data accuracy. This is where an Accounting Service in Sacramento can streamline every financial aspect while giving decision-makers clarity.

Key benefits of professional accounting support:

- Accurate and timely financial reporting

- Improved compliance with state and federal guidelines

- Data-driven insights for smarter planning

It’s easier to focus on growth when your books are balanced, your data is accurate, and your time isn’t lost in endless reconciliations.

The Seattle Perspective on Modern Accounting

Organizations operating on the West Coast face evolving state-level compliance demands. An Accounting Service in Seattle ensures local expertise while maintaining consistent financial standards across departments.

What makes a strong accounting system valuable:

- Simplified cash flow tracking

- Standardized financial statements

- Greater control over audits and reporting cycles

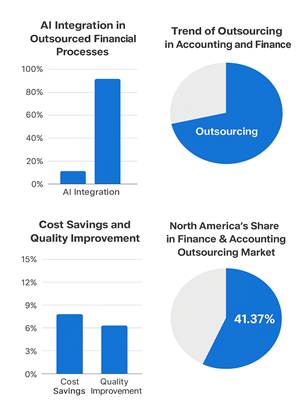

Deloitte’s 2024 Global Outsourcing Survey found that 83% of executives integrate AI into outsourced financial processes, showing how automation is reshaping accounting efficiency across cities like Seattle.

Time, Transparency, and Technology

Modern accounting blends technology with transparent data control. RTN CPA provides tools that let leaders view their finances in real-time, making it easy to spot risks and opportunities.

Here’s how technology-driven accounting adds value:

- Automates manual tasks such as payroll and expense tracking

- Enhances transparency through cloud dashboards

- Strengthens decision-making with predictive analysis

Forbes highlights that outsourcing in accounting and finance is an accelerating trend, with more organizations shifting transactional functions to external experts.

Simplifying Complexity for Multi-Branch Operations

Managing finances across Sacramento, Seattle, and beyond can create inconsistencies. Professional accounting services centralize your financial ecosystem, offering uniformity across every branch.

Core outcomes of unified accounting services:

- Standardized reporting formats

- Centralized data storage and access control

- Error reduction through automated reconciliation

According to a 2024 ISG study, organizations report an average of 15% cost savings and 11% improvement in quality when outsourcing financial processes.

Data Accuracy and Decision Confidence

Every executive understands the cost of inaccurate numbers. Quality accounting builds confidence in budgets, forecasts, and strategy decisions.

How accounting accuracy supports leadership goals:

- Strengthens board reporting and donor confidence

- Reduces compliance risk

- Improves audit readiness with well-structured records

Mordor Intelligence Finance and Accounting Outsourcing Market Report notes that North America accounts for 41.37% of the global outsourcing market, reflecting a strong regional demand for reliable financial services.

Table: Key Statistics and Sources

| Statistic | Context / Usage in Blog | Source & Year | URL |

| 83% of executives integrate AI into outsourced financial processes | Demonstrates technology adoption in accounting services | Deloitte, Global Outsourcing Survey, 2024 | Link |

| Outsourcing in accounting and finance is an accelerating trend | Supports the trend of shifting transactional tasks to external providers | Forbes Finance Council, 2024 | Link |

| 15% average cost savings and 11% improvement in quality | Highlights efficiency benefits from outsourced accounting processes | ISG, 2024 | Link |

| North America accounts for 41.37% of the finance and accounting outsourcing market. | Shows regional relevance for Sacramento and Seattle | Mordor Intelligence, 2024 | Link |

Aligning with Growth and Strategy

Sustained growth requires more than number crunching as it demands strategic insight. Accounting services turn financial data into actionable intelligence that supports expansion goals and funding decisions.

Strategic Advantages offered by professional accounting:

- Cost optimization insights

- Forecasting accuracy

- Scenario-based budget planning

As Deloitte’s research shows, outsourcing financial management continues to expand, helping organizations adopt data-led strategies that improve efficiency and long-term stability.

Accountability Meets Efficiency

RTN CPA works with clients to create structured, scalable accounting systems that fit seamlessly within their operational framework. The result is accountability combined with measurable financial efficiency.

Core Operational Benefits:

- Continuous monitoring of financial health

- Customized dashboards for executive visibility

- Faster month-end closing cycles

Efficiency isn’t about doing more work as it’s about spending less time fixing problems that could have been avoided through proactive oversight.

The Sacramento–Seattle Advantage

Operating across two major cities gives organizations unique insights into economic diversity. Both regions demand precision in tax compliance and budget control, and professional accounting services ensure your numbers stay accurate regardless of reporting and compliancecomplexity.

City-Specific Benefits Include:

- Sacramento: smoother coordination with state-level fiscal regulations

- Seattle: advanced automation adoption for data accuracy

- Consistency across multi-jurisdictional accounting standards

When managed correctly, these dual-region dynamics can lead to greater adaptability and financial sustainability.

Conclusion

Sound accounting forms the backbone of stability and strategic decision-making. Whether it’s an Accounting Service in Sacramento guiding your compliance or an Accounting Service in Seattle optimizing your operational flow, the right partner simplifies complexity.

RTN CPA continues to help organizations align precision with purpose, ensuring finances support vision, not hinder it. The result is clarity, control, and confidence in every transaction that drives long-term growth.

Frequently Asked Questions

Q. What does an Accounting Service in Sacramento typically handle for small businesses?

An Accounting Service in Sacramento can manage bookkeeping, payroll, tax filings, and financial reporting, ensuring small businesses remain compliant and financially organized.

Q. How can an Accounting Service in Seattle help with tax preparation?

Accounting Service in Seattle professionals provide accurate tax preparation, identify deductions, and help businesses and individuals minimize liabilities while staying compliant with local and federal regulations.

Q. Are Accounting Services in Sacramento suitable for startups?

Yes, Accounting Services in Sacramento can support startups by setting up accounting systems, creating budgets, forecasting cash flow, and guiding financial decision-making from day one.

Q. Can an Accounting Service in Seattle assist with financial audits?

Absolutely. An Accounting Service in Seattle can prepare businesses for audits, ensure financial statements are accurate, and help meet regulatory standards with minimal disruption.

Q. What industries can benefit from Accounting Service in Sacramento?

Accounting Service in Sacramento serves various industries, including retail, tech, healthcare, and manufacturing, providing customized solutions for bookkeeping, payroll, and financial planning.

Q. How do Accounting Services in Seattle improve business efficiency?

Accounting Services in Seattle streamline financial processes, provide real-time insights into cash flow, and offer strategic guidance that helps businesses make informed decisions faster.

Q. Why should I choose a local Accounting Service in Sacramento over a remote option?

Local Accounting Service in Sacramento understands regional tax laws, regulations, and market conditions, offering personalized support and face-to-face consultations that remote services may not provide.