Table of Contents

ToggleIntroduction: Financial Leadership Without the Full-Time Cost

Financial management can be one of the most complex aspects of running a growing company. Even with a strong business model and a skilled team, cash flow inconsistencies, reporting gaps, and strategic planning challenges can create roadblocks. Fractional CFO services provide executive-level financial guidance without the cost of a full-time CFO, making it easier for companies to scale confidently.

Companies in Sacramento and Los Angeles often face rapid growth alongside limited financial resources. Fractional CFO services provide leadership teams with executive-level insight while controlling operational costs.

- Access strategic financial advice without hiring a full-time CFO

- Support decisions with actionable, real-time data

- Optimize resource allocation for growth initiatives

Fractional CFOs bridge the gap between financial complexity and executive decision-making, helping you stay focused on sustainable expansion.

What are Fractional CFO Services?

Fractional CFO services are part-time or outsourced engagements delivering CFO-level expertise. They allow companies to manage finances effectively without the full overhead.

- Provide oversight across financial reporting, budgeting, and cash management.

- Adapt to businesses of various sizes, from startups to mid-sized companies

- Deliver flexible, scalable solutions based on company needs

Businesses in Sacramento and Los Angeles frequently use fractional CFO services to maintain growth momentum while minimizing risk.

Key Benefits for Growing Companies

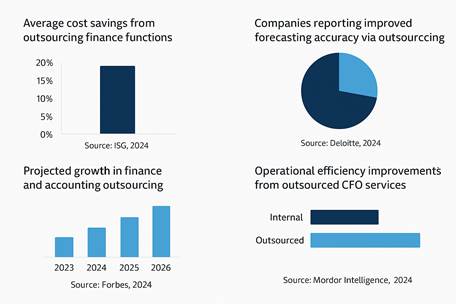

Fractional CFOs improve clarity, strategy, and measurable outcomes for leadership teams. Research shows that companies outsourcing finance functions achieve 15% average cost savings compared to fully internal teams (ISG, 2024).

- Executive-level strategy at a fraction of the cost

- Timely, accurate financial reporting for board members and stakeholders

- Enhanced risk assessment and scenario planning

- Increased investor confidence and funding readiness

These benefits ensure companies can scale efficiently while maintaining strong financial governance.

Strategic Financial Planning and Forecasting

Accurate planning and forecasting are crucial. Fractional CFO services in Sacramento help anticipate financial challenges and seize opportunities.

- Develop budgets and long-term projections.

- Monitor performance metrics and KPIs

- Conduct scenario analyses for revenue fluctuations and market shifts

Deloitte’s 2024 survey shows that over 70% of companies adopting finance and accounting outsourcing report improved forecasting accuracy, demonstrating the tangible impact of strategic guidance.

Enhancing Cash Flow and Profitability

Cash flow management is a top priority. Fractional CFO services in Los Angeles focus on optimizing liquidity and identifying revenue drivers.

- Implement cash management systems and forecasting models

- Evaluate costs and identify potential savings

- Refine pricing strategies and revenue streams

According to Mordor Intelligence, companies leveraging outsourced CFO services see measurable improvements in operational efficiency, leading to better profitability margins.

Compliance, Risk Management, and Governance

Regulatory compliance and risk oversight can be overwhelming. Fractional CFOs strengthen financial governance and reduce exposure.

- Ensure adherence to federal, state, and local regulations

- Establish internal controls to prevent errors or fraud

- Prepare organizations for audits and investor scrutiny

Forbes reports that outsourced accounting services allow executives to focus on strategic planning while reducing compliance risk, especially in growth-phase companies.

Technology and Reporting Advantages

Modern CFOs rely heavily on technology for efficiency. Fractional CFOs integrate platforms and dashboards for real-time insights.

- Implement cloud-based financial systems.

- Automate reporting, reconciliations, and cash tracking.

- Deliver real-time, actionable data for decision-making.

Deloitte’s 2024 survey found that over 65% of companies using outsourced financial services improved decision-making speed and accuracy through technology integration.

Choosing the Right Fractional CFO Partner

Selecting the right partner is essential. RTN CPA delivers fractional CFO services in Sacramento and Los Angeles, offering insight combined with practical execution.

- Look for experience with companies of similar size and sector

- Ensure knowledge of local tax and regulatory requirements

- Evaluate communication style for seamless collaboration

The ideal partner becomes an extension of your leadership team, providing insight without disruption.

Table of Key Statistics and Sources

| Statistic / Insight | Value / Finding | Source |

| Average cost savings from outsourcing finance functions | 15% | ISG, 2024, ISG Press Release |

| Companies reporting improved forecasting accuracy via outsourcing | Over 70% | Deloitte, 2024, Deloitte Global Outsourcing Survey |

| Companies are reporting faster and more accurate decision-making | Over 65% | Deloitte, 2024, Deloitte Global Outsourcing Survey |

| Projected growth in finance and accounting outsourcing | Significant growth expected in 2024 | Forbes, 2024, Forbes Finance Council |

| Operational efficiency improvements from outsourced CFO services | Measurable improvement | Mordor Intelligence, 2024, Mordor Intelligence Report |

Visualizing these statistics can significantly improve readability and engagement for presidents, NGO leaders, and small-business executives. Bar graphs could display average cost savings, highlighting the 15% reduction with outsourcing, while a pie chart can illustrate 70% of companies reporting improved forecasting accuracy.

A line graph can track projected growth in finance and accounting outsourcing, giving executives a quick sense of market trends over time. For operational efficiency, a horizontal bar chart comparing internal vs. outsourced CFO performance could emphasize measurable gains reported by companies in Mordor Intelligence’s study.

Additionally, stacked bar charts can showcase faster decision-making and improved reporting accuracy, visually reinforcing Deloitte’s 65% statistic. Using consistent colors for Sacramento and Los Angeles can create geographic context, while short labels and percentages keep graphs skimmable. These visual elements make the blog more digestible, allowing executives to grasp the value of fractional CFO services at a glance and reinforcing key decision-making insights.

Conclusion

Fractional CFO services in Sacramento and Los Angeles help companies manage finances strategically, optimize cash flow, and maintain compliance without hiring a full-time executive. RTN CPA provides tailored solutions that strengthen financial governance and empower executives to make informed, confident decisions.

Frequently Asked Questions

Q 1- What are fractional CFO services in Sacramento?

Fractional CFO services in Sacramento offer part-time or outsourced financial leadership, providing strategic insight and planning for growing companies.

Q 2- How do fractional CFO services in Los Angeles differ from full-time CFO roles?

They deliver flexible, project-based engagement rather than full-time employment, providing high-level guidance cost-effectively.

Q 3- Can small businesses benefit from fractional CFO services in Sacramento?

Yes, small businesses can optimize cash flow, planning, and reporting without full-time staffing costs.

Q 4- Are fractional CFO services in Los Angeles suitable for nonprofits?

Yes, they support budgeting, financial reporting, and compliance, allowing leadership to focus on mission delivery.

Q 5- What is the cost advantage of fractional CFO services in Sacramento?

Companies avoid full-time salaries and benefits while gaining executive-level financial strategy and oversight.

Q 6- How quickly can fractional CFO services in Los Angeles be implemented?

Implementation can typically occur within a few weeks, depending on the company’s complexity and reporting needs.

Q 7- Do fractional CFOs in Sacramento handle tax compliance?

Yes, they manage federal, state, and local compliance, ensuring accurate filings and reducing financial risk.